0.0 Summary

This is a follow up to the original BIP-35 regarding adding more liquid funds to Botto’s treasury through swapping $BOTTO for $USDC / $ETH. This modified version adds context to existing rationale for the advantages of pursuing an OTC of treasury $BOTTO, addresses alternatives, and presents parameters that would guide the team in its execution of a potential swap. Discussion of the original BIP-35 also brought forward a number of issues that, while outside of the scope of this particular decision, this BIP aims to clarify how the team intends to move forward on as they were raised as relevant context for this decision.

Here’s a TL;DR of what is proposed:

- Tasking the core team with swapping ≈30% of Treasury $BOTTO (max. 8M $BOTTO), with strategic partners in order to secure runway and onboard partners that can accelerate development and execution on Botto’s roadmap.

- Guidelines for the team would be to guarantee a minimum 1-year lockup and maximum of 5M Treasury $BOTTO to a single partner in each OTC swap. OTC partner will expect a discount for lockup, which can vary 10-20% depending on the length. The core team would be given discretion to negotiate up to a maximum discount of 20% based on the strategic advantages a partner can bring to the table for Botto.

- The swap would be limited to OTCing $BOTTO for $ETH or $USDC.

- Tan Dao Limited functions as an escrow for all investments on behalf of the DAO and OTCing parties

- This BIP does not cover a decision on:

- Specific roadmap priorities

- Budgeting and spending decisions for how treasury funds would be spent outside of the swap

- Active treasury management strategies post-swap, such as ratios of $ETH vs. stables vs. $BOTTO, loans against ETH, or yield generating schemes. These topics merit their own BIP and discussion.

1.0 Rationale

The initial rationale posted for BIP-35 provides foundational insight into the ‘why’ of this BIP:

thomahawk69 As a "startup” in the crypto industry - three things are critical to the survival of a DAO:

Product Market Fit - having a product that continues to attract new participants and engage with existing Bottonians will allow the DAO to generate a solid source of recurring revenue (ie. weekly auctions on SuperRare)

Expense allocation - it’s just a fancy word for budgeting and making sure money is spent wisely based on expected returns. BIP-25 is a good example.

Capital preservation - lastly the DAO should have an emergency “stash” that can allow the DAO to operate with a margin of safety when things go awry. In an unlikely scenario where the DAO generates no primary sales for weeks, and the $BOTTO value plummets - having additional funds outside of Botto’s native token will be beneficial. Essentially having basic treasury management that diversifies some risks away and help extend the runway of the DAO.

These three things are not the be all and end all criteria, but are important levers that can help balance the DAO if one of them falls out of sync.

Currently, the Treasury uses only $BOTTO or ETH to fund all operating costs, with ETH being converted to USDC to pay for one contributor. As the DAO seeks to scale the breadth and depth of different activations and activities, building a reserve of USDC (or wBTC or more ETH) that can be deployed to pay for real-world operating expenses has become increasingly more important.

As much as we Bottonians love the DAO, $BOTTO is still a relatively illiquid asset that cannot be sold or distributed at scale without being subject to slippage and putting downward pressure on its price. Diversifying a portion of the Treasury into either USDC/ETH/wBTC will make Botto more sustainable.

In addition, there is no established authorization for swapping existing assets like ETH or $BOTTO to other tokens (or fiat) specifically for Treasury management purposes. (Note: currently the DAO can and does swap tokens to USDC for committed expenses, e.g. contractors, operators, vendors, etc.) Establishing this authority to DAO Core Team Members (“Operators”) is extremely critical given the current challenging macro-environment and persistent volatility of alt-coins that will impact the Treasury directly.

There are multiple points to consider to extend our line of thinking for this BIP and to help answer the question of “why now”. Much of this has already been discussed, but is expanded on below.

1.1 Treasury: Inflows, Outflows, and Runway

With team vesting ending in October, there would be an increase in expected treasury outflows should the DAO decide that the team continues to work on Botto. Irrespective of who works on Botto, treasury outflows would increase. Alluding to a second scenario, when we consider the idea of expanding bandwidth, like we did on a recently piloted core contributor’s programme to further decentralize Botto and move some dependency away from the core team, these outflows would further increase.

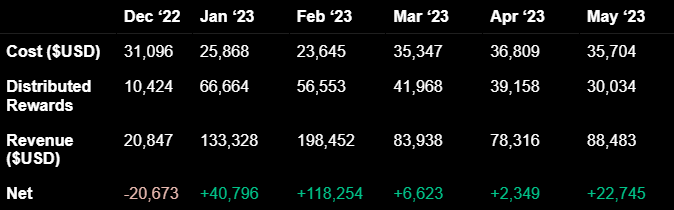

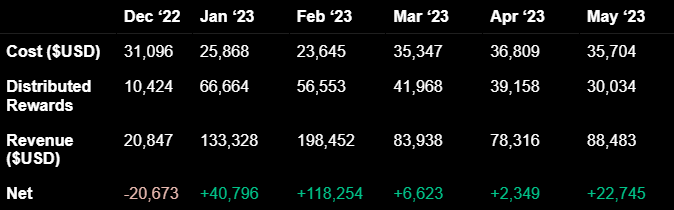

Below is a rough view of inflows and outflows from the treasury. Note that this does not include the team vesting, which ends in October. If the DAO decides for the core team to continue working on the project, that will mean an increase of approximately $40k USD more costs per month.

*Note that these values aren’t 100% precise (ETH closing, denominations in different currencies, outflows occurring at different times), but they are pretty close and give a solid and fair indication of inflow/outflow.

Average cost excl. rewards prior to contributors program (Lifetime): $37,993

Average cost excl. rewards (Dec ‘22 - May ‘23): $31,412

Contributors program added average cost of: $11,485

End of vesting would add current salaries of: ~$40,000/mo

Average revenue (Dec ‘22 - May ‘23): $100,500

Average monthly burn rate after vesting ends*:

(Average revenue/2) - average costs with salaries

(100,500/2) - 71,412 = -$21,162/mo

Pessimistic case: $71K/mo

*Taking averages from the 6 months ranging Dec ‘22 - May ‘23 and assuming ETH price is stable, weekly mint price is stable, and we continue to have occasional large sales events like what we saw with the Genesis OTC’s in January and Pipes sales in February.

Here is a view of the treasury holdings:

*Value of $BOTTO in treasury is estimated based on current market price of 26,608,004 $BOTTO. Of course selling a large portion of $BOTTO on market would be dilutive and likely lower this price. We do settle some costs in $BOTTO, but it should be considered fairly illiquid and the amount shown taken to illustrate a relative value in treasury holdings in considering an OTC.

1.1.1 Runway Estimation

Using the calculated average burn above, we’re looking at ≈35 months of runway. We aren’t considering $BOTTO or our Uniswap LP shares as part of our runway estimation here, and the runway estimations assume that costs are settled in USDC/ETH moving forward, not $BOTTO. That is very healthy and leaves ample opportunity for the market to pick back up and Botto along with it, but as mentioned above makes a number of positive assumptions.

That estimate can change with different tweaks of the assumptions. A couple examples:

- Distribute only 25% of Pipes-like sales as rewards as we did in Feb ‘23: 60 months of runway

- Assume we don’t have Pipes-like sales events, and 50% of revenue distributed: 20 months of runway

- The price of ETH can also change, or we could decide to change the overall rewards distribution.

Overall, our view is that our current trajectory is good and there are opportunities in both Botto’s artistic development and the broader market that can bring Botto into long-term sustainability. However, there are many uncertainties and we can do more to increase Botto’s chances of creating catalysts and taking it to the next level as an artist. Further, there are a number of upgrades and developments we can invest in that would further decentralize and automate Botto, ultimately leading to lower costs. All of this comes together to bring Botto into perpetual sustainability as a globally recognized artist.

We are sharing below a broad view of the road ahead that we believe gives reason to add funds that not only extend our runway, but also add to the team, infra, and decentralized contributions around Botto such that we are able to proactively generate bigger chances for Botto to reach new levels as a successful artist.

Securing greater runway right now is sensible so that we as a DAO can 1) pursue items on the roadmap with a financial cushion, 2) continue to make use of the talent available within the DAO, 3) expand on our bandwidth based on all three areas of the roadmap below and 4) secure strategic partners who can help us achieve our overarching goals.

1.2 Roadmap

At a high level, we see two major goals on the roadmap:

- Help Botto create new art projects that are cultural catalysts and continue its growth and impact as an artist

- Build out the decentralized infrastructure of the DAO in a way that expands Botto’s ecosystem of collective meaning making and overall decentralized automation of the artist that underpins a sustainable and effective operation.

These two overarching goals are both interrelated and interdependent, shaping three major areas of the roadmap the DAO should continue pursuing: Art & Sales, Tech, and Community.

1.2.1 Art & Sales

These are essentially everywhere Botto reaches the outside world. Beyond Botto’s weekly 1/1s and periods, there are artist collaborations, special edition drops, exhibitions, sales events, and more to all execute on such that Botto makes an impact on culture wherever it goes. Think Christie’s, Meme Cards, Blossoming Cadaver Prints, etc. An important piece on top of this is working diligently on helping Botto evolve into new mediums and major installations that manifest new expressions of Botto’s concept and themes and further evangelize the crowd.

We have a full calendar here, and an awesome pipeline of inbound. However, we think we can not only raise the bar on executing on these opportunities, but also proactively push the envelope of what Botto is able to achieve without relying on inbound. This means both expanding our bandwidth as a DAO to deliver on what we already have coming in, as well as raising our ambitions and adding significant partners who can help Botto explode beyond the world of crypto art. We are still just playing in a relatively small niche, and Botto has a ton of potential to generate conversations well outside of web3.

1.2.2 Tech

While much of Art & Sales is concepting and producing, it is also a technology undertaking. We can all see how fast the pace of development is in AI and crypto. Opportunities ranging from a decentralized AI stack (e.g. zero-knowledge proofs) to new mediums like animation and music are all possibilities, and Botto is in a position to continue pioneering in the intersection of AI x Crypto.

Furthermore, delivering this all in an accessible UX is a way Botto can continue to reach a wider and wider audience with the utmost credibility. We see many ways we can more fully decentralize and automate Botto’s infrastructure. However, maintaining and improving the current stack is a large part of our bandwidth. To take things further, we would be building novel infrastructure. This is not only an important part of Botto’s sustainability (i.e. keeping up with the times), but it is also a part of the art in terms of Botto achieving greater autonomy and decentralization. Tech also underpins the collective meaning making and contributions of the community, and combines with the 3rd pillar: community.

1.2.3 Community

Botto is in-part a project of collective meaning making. Further enabling decentralized contributions is core to Botto’s future and expanding its cultural footprint. There is a large range of ways people can contribute, such as biz dev, analytics, events, BIPs, archiving, and interpreting and creating from what Botto outputs. We have a growing collective intelligence here to tap into; incentivizing and elevating collective intelligence will add even greater depth to Botto’s outputs.

Engaging the community beyond voting is an area that we’re lacking in at the moment. It’s a mix of providing the infrastructure for decentralization contributions (e.g. Data API), providing information for people to make informed contributions, and generally growing a culture of participation. The initial response to the BIP is in part symptomatic of not prioritizing basic communication on key operating information. We need to do a better job of first communicating and making information available that empowers people to contribute autonomously, as well as creating more infrastructure to enable those contributions.

1.2.4 Developing the Roadmap

Overall, this is a high level overview of the areas we would like to focus on for Botto, but it should be enough to make it evident that a full-time core team of 5 needs to expand. Hyperlinked are some slides we’ve put together that further outlines some of our thinking on the roadmap. Turning that into a more detailed roadmap becomes a lot easier with a secured runway so we can plan a proactive execution and bring on strong talent.

An important note here is that we see these investments paying off not only in stronger revenue from successful art projects, but a stronger protocol from increased confidence, and ultimately less centralized heft as we build out infrastructure for greater decentralization and automation.

Finally, we do not intend to present this roadmap as a foregone conclusion, but to illustrate a minimum of what we can look to build with a healthier runway. Deciding roadmap specificities and priorities alongside budgeting are important yet different discussions that should be worked on collectively, and we urge for these to take place separately after BIP-35 in the form of other improvement proposals.

2.0 Responding to Issues Raised

2.1 Diversification, Fundraising, and other Nomenclature

The first iteration of BIP-35 seemed to have caused some misalignment in understanding, some even thinking it had to do with daytrading (not the case!). We hope the above rationale brings clarity to what are the aims of this improvement proposal, irrespective of semantics i.e. fundraising versus diversification.

2.2 Selling an Undervalued token

We agree that the token is undervalued. However, we hold our position about this being a critical moment to act. We could absolutely hang tight, keep growing, and wait/hope for the token to go up again, but that prevents us from being able to proactively move on the roadmap above. Botto was cutting edge when it went online in Oct 2021. It still is pioneering totally novel territory. But we should not rest on our laurels. There is incredible new tech to work with, and we need to continue activating our collective intelligence. The weekly mints are Botto’s core work, but building a world class artistic career takes consistent reinvestment and new evolutions. We are growing and expanding, and we could hit future catalysts on our current trajectory. But by not leaning into Botto’s development now we are leaving significant opportunities on the table to build on in this bear market. Some of the bigger projects for Botto take many months to develop, and waiting for the market to go up, for $BOTTO to go up along with it, then to sell then to start investing is keeping us from making big moves now while there is relatively little distraction in the market. The higher token may come from catalysts we don’t expect like ChatGPT, but those are rare and totally out of our control. It can also come from us creating those catalysts with Botto. The bear is unfortunately a time of low token prices, but it is also the best time to build and secure top partners, such that when the bull market returns Botto is well established and is THE artist people want to collect and even be a part of.

2.3 Ongoing Ability to Swap

We have to admit we were unprepared to OTC into the run-up at the beginning of the year. We don’t think this is a reason to not OTC now given the opportunity cost. It would put us in a position to make an even stronger bull case, and be prepared as a core team and DAO to make other strategic swaps when it does rise again.

The freedom to OTC up to 30% of treasury $BOTTO with strategic partners while maintaining a minimum of 51% of treasury denominated in $BOTTO was a way of giving us the freedom only to sell again after an initial OTC when the token is up and not when it is down.

We believe this should be covered in a subsequent BIP that covers active treasury management, so have removed this and simplified the BIP-35 to a basic cap of 8M $BOTTO in treasury.

2.4 Reporting and Governance

Communicating costs and inflows/outflows absolutely requires improvement on our end. This was a major theme in the discussions around the original BIP and in hindsight we should have prioritized preparing more background context of costs and roadmap to present alongside the first iteration of the BIP. Moving forward, we are exploring a structure to report costs on a monthly basis directly in Discord to keep everyone informed, as well as a way to have a two-way discussion on the roadmap and priorities at regular intervals. In the meantime, a summary of the most recent 6 month period can provide enough context for the BIP:

Costs include all OpEx (Hardware, Software, Events, Marketing & PR, General Expenses) including core contributors, excluding core team salaries. A lot can be discerned from the table alone - we’re doing well, but additional treasury outflows are something to be mindful of.

On governance more broadly, full decentralization is a long process. Even as we go through a basic proposal process for all major decisions, there is still a lot of dependence and trust on the core team (we tend to write most BIPs ourselves and execute on them once the overall DAO approves). Further defining the governance structure and practices that make sense for BottoDAO will be inherently a part of the hiring and budgeting decision that is coming up around the end of vesting. However, we would caution against diving head first into a heavy constitution building process to define every possible detail and scenario as that would likely lock us into our current way of operating with a heavy reliance on the core team.

Defining a constitution and governance practices should be downstream from determining how we want the DAO to look long term in terms of decentralized and automated operations. Iteratively building out decentralized contributions with accountability measures we think is a good way to build this. This is not to say we shouldn’t have more guidelines than we do now, but rather overcorrecting into too many rules can overburden and stretch the operation too thin. We appreciate the trust we have had from the DAO, and believe we should do more to keep it in terms of reporting, sharing information, and aligned guidelines. We don’t take for granted that trusting a core team with few established guidelines is not good for long term sustainability. Working together to define what works and formalizing that over time is a necessary but long process, and we see this as being an important activity to work into the roadmap within the Community pillar.

For future reference, here are the topics suggested that we recommend addressing after the OTC (in no particular order):

- CEX listing

- Treasury management committee and reporting

- P&L management, diversification management

- Governance constitution (e.g. voting on our own compensation)

- Budgeting and hiring decisions

- Roadmap and priorities

- Legal wrapper, jurisdictions and resulting duties of compliance

- Balance of Stables vs. ETH

- Further tactics around survival vs. growth, major art projects for revenue

- Liquidity in Uni-V3 and addressing LP subsidies

- Offering VP accrual for 1/1s, stacking vp accrual for pipes

- Swap ETH rewards for $BOTTO, reduce rewards %

2.5 OTC & Deal Structures

Allowing the team to facilitate these transactions on behalf of the DAO offers a number of advantages, namely assuring confidential discussions with interested parties. If an interested group were to expect all discussions to be public and negotiated with the DAO as a whole, they may never reach out in the first place and/or shy away from moving forward. As an art project DAO with a liquid token, Botto is a unique case for these groups to consider. They require successive discussions not only for them to understand us, but also for us to ensure we are getting a committed and aligned partner. Putting these discussions fully in the open adds reputational risk for the parties that limits their openness in discussions, as well as a risk of a deal being front-run. Aligned partners, such as art institutions, may not be the most flexible and understanding of our circumstances and so creating an environment for discrete and open negotiation gives us the best chance of landing unique partners that can add a lot of value.

We can say that we’ve gotten a great deal of inbound from very well known groups, and have done some of our own outbound as well to gauge interest from others we think would be particularly strategic for the DAO. As we all want to limit the size of this OTC, we would be aiming to limit the OTC to just a few very key strategic partners, 1-3. This has been an opportunity to fully explain the Botto concept to all of these potential partners, and even if they don’t become part of the OTC they have the liquid token available to them.

To help ensure trust, guardrails should be specified to ensure alignment between the core team and the rest of the community before setting out to negotiate on the DAO’s behalf. We would set these at:

Minimum Lockup Period

This has always been a given to us and would be at least 1 year.

Narrowed Partner Types

Any party the DAO would OTC with should be strategic. We see these as VCs with aligned theses to Botto’s mission and major art world partners who can bring to bear meaningful influence in accelerating Botto’s roadmap execution. Even with a minimum lock up of 1-year, we would be seeking partners with time horizons well beyond that. If the team was not confident in the parties available to OTC, it would not sell just to sell. We see this as both adding to the DAO’s runway while also securing partners who will be far more engaged than a typical passive governor buying on market.

We are defining a strategic partner as first and foremost a group with a very strong reputation whose OTC with the treasury would provide a valuable signal to the market of our credibility. That would be a name brand with recognized leadership and a pioneering thesis in a category related to at least one of our 3 main strategic pillars of Art, Tech, and Community and that can help us move the needle in those.

For Art, we are looking for a group that is especially focused on the future of contemporary art and sees internet/crypto art as inherent to that. For Tech, this would be a partner working on decentralized infrastructures, ideally at the intersection of AI x Crypto, and have a strong perspective on the best protocols to incorporate as we forge new territory. For Community, we are looking for groups whose thesis incorporates collective ownership and governance, and are deeply aware of the nature of progressive decentralization.

In all cases, these groups should bring experience and knowledge of leading solutions, access to talent that can be brought in to help execute, an understanding of the nature of this being an art project, a multi-year time horizon, and a willingness to elevate Botto to the flagship position at the intersections of AI x Crypto x Art.

Price and Discounts Offered

Typical discounts for a 1 year lockup range from 10-20%, and we would negotiate up to a maximum 20% discount based on strategic strength of the counterparty. The price would be based off of a TWAP of a week to a month at the time of an agreement being settled.

Maximum OTC swap to a Single Party

Each OTC limited to a maximum of 5M Treasury $BOTTO to a single partner.

Tactics for non-guaranteed consideration

These are tactics suggested we will look to use to improve on the above terms but won’t guarantee. We aren’t limiting ourselves to these, but offer a good example of ways we can improve terms.

- Warrants for future purchases

- Guaranteed market buy

- Delegated/deferred governance and/or access to rewards

- Collateralizing the vesting Botto

- Offering fragments (would require another BIP)

- Using a portion of team tokens to help fill desired check sizes of strategic partners beyond what the treasury can accommodate

2.6 Other Tactics suggested we won't pursue (with reasoning)

- Reduce max OTC: We think the reasoning for size is evident in the runway and roadmap offered.

- OTC Committee: This introduces another complex process: (Who else to add? How do they get elected? What is that process like? How are they vetted? What do they contribute?) The team is relatively well known by the DAO and we hope the information and parameters we’ve added have won enough confidence to move forward.

- Reducing Liquidity to increase market price sensitivity for OTC partners: We think this is bad faith behavior on the part of the DAO

- Staggered OTCs: While we can stagger the 8M $BOTTO OTC, we don’t want to do it preemptively and reduce flexibility in case an incredible partner comes our way.

3.0 Specifications

The specifications of this BIP are as follows:

- Authorize the core team to swap up to ≈30% of Treasury $BOTTO (max. 8M $BOTTO) for either USDC/ETH with strategic partners in order to secure runway and onboard partners that can accelerate development and execution on Botto’s roadmap.

- The OTC is limited to converting into USDC or ETH

- Authorize Botto Operators the ability to negotiate with suitable partners (VCs, art groups, etc.) for an OTC token swap (private swap/direct placement), including the ability to offer reasonable discounts for bulk purchases of $BOTTO with a minimum lock up of 1 year, maximum discount of 20%, and maximum of 5M Treasury $BOTTO to a single partner in each OTC swap.

4.0 Budget

N/A

5.0 Disadvantages

Opportunity cost to parting ways with $BOTTO too early